How Much Accident Insurance Coverage Should a Private Pilot Carry?

When you’re 5,000 feet in the air, your accident insurance coverage should be the last thing on your mind. For private pilots, flying represents freedom and discipline, but it also carries risks that many standard, off-the-shelf policies simply were not designed to cover.

After reviewing dozens of aviation-related accident policies, one thing is consistent: the fine print often tells a very different story than the marketing. Phrases like “excluding losses resulting from non-commercial aviation” are more common than most pilots realize.

In the insurance world, private flying is frequently labeled a high-risk hobby. The problem is that for many pilots, it is not just a hobby. It is part of their identity, their lifestyle, and sometimes their business. That is why accident insurance plans should never be an afterthought. It is not about checking a box. It is about protecting your family, preserving your income, and ensuring that one unexpected event does not cause long-term financial turbulence.

In this guide, we will break down how much accident insurance coverage a private pilot should carry, what to look for in a policy, and how to avoid costly gaps before your next takeoff.

How Much Accident Insurance Coverage Does a Private Pilot Need?

Quick Answer:

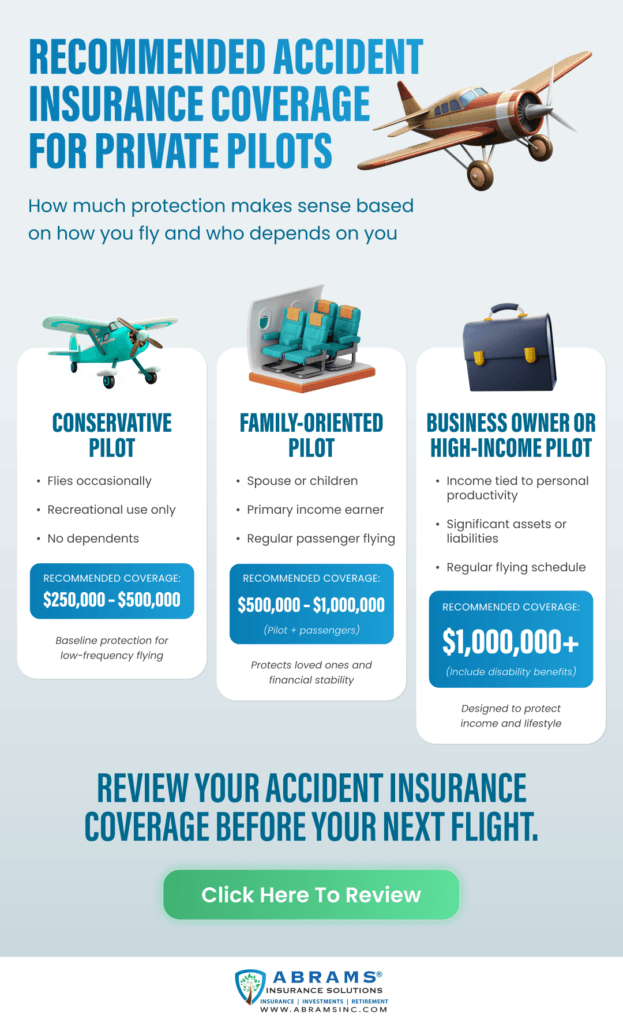

Most experienced aviation insurance advisors recommend that private pilots carry between $500,000 and $1,000,000 in aviation-specific accident insurance coverage. A baseline of $250,000 may be appropriate for solo, low-frequency flyers, but pilots with dependents or frequent passengers should strongly consider $1 million or more to protect income, debt obligations, and family stability. Most importantly, the policy must be aviation-specific to avoid the exclusions commonly found in employer-provided plans.

What Is Accident Insurance Coverage for Private Pilots?

Accident insurance coverage, often called aviation accident insurance or personal accident insurance, is a specialized policy that pays a lump-sum benefit in the event of accidental death or dismemberment (AD&D) while operating a non-commercial aircraft. These policies are often structured as aviation-specific Accidental Death and Dismemberment (AD&D) coverage, though some may also include defined benefits for certain permanent disabilities.

Unlike health insurance, which reimburses medical bills, or traditional disability insurance, which replaces income over time, accident insurance pays a direct cash benefit to you or your beneficiary. It’s not tied to actual expenses, and it pays regardless of fault, provided the event meets the policy’s definition of a covered accident.

Why Does Standard Accident Insurance Often Exclude Private Pilots?

Most people assume their employer-sponsored AD&D (Accidental Death and Dismemberment) or personal accident insurance covers them everywhere. Unfortunately, for private pilots, this is a dangerous assumption.

Standard policies frequently include aviation exclusions. This means if you are injured or killed while piloting a Cessna 172 or a Cirrus SR22, the policy may pay out exactly zero.

The Difference Between Aircraft Liability and Personal Accident Insurance

Before we dive into the numbers, it’s crucial to distinguish between the two:

- Aircraft Liability Insurance: This covers damage you cause to others (passengers, people on the ground, or other aircraft).

- Personal Accident Insurance (PAI): This covers you. It provides a lump-sum payment if you suffer a serious injury, lose a limb, or pass away due to an accident.

For a private pilot, personal accident insurance is the “safety net for the pilot’s family,” whereas liability is the “safety net for the pilot’s assets.”

Why Standard Aviation Insurance Isn’t Enough?

Most private pilots assume they are “fully covered” because they have a stack of policies. However, there is a massive difference between protecting your plane and protecting your person.

Here is the breakdown of the gaps you likely have right now:

| Coverage Type | Who It Protects | What It Misses |

| Hull Insurance | The aircraft | It pays for the metal, not your medical or family needs. |

| Liability Insurance | Others | Covers people you hit; offers $0 for your recovery. |

| Health Insurance | Medical bills | Covers the hospital, but doesn’t replace your mortgage-paying income. |

| Employer Life Insurance | Beneficiaries | Danger: Almost always contains a “General Aviation” exclusion. |

The key point is that, for many insurers, private flying is a “hazardous hobby.” If your policy doesn’t explicitly name Accidental Death and Dismemberment (AD&D) for non-commercial aviation, you are essentially flying uninsured.

How Much Accident Insurance Coverage Should a Private Pilot Carry?

There’s no one-size-fits-all number, but there is a framework that works, which is based on five real-world factors:

1. Your Dependents and Financial Obligations

Before choosing an amount of accident insurance coverage, ask yourself one honest question: if something happened to me tomorrow, what financial weight would my family be left carrying?

That includes everyday obligations like a mortgage or rent, whether your income or business supports others, children, or dependents who rely on you, existing debts, and future costs such as college or ongoing care.

As a general guideline, a single pilot with no dependents may be well protected with $250,000 to $500,000 of coverage, while someone who is married or whose income supports a family should usually consider $500,000 to $1 million or more.

However, it is important to remember that accident insurance isn’t meant to replace a full life insurance policy. Still, it can provide immediate financial breathing room, help cover sudden disruptions, and prevent your family from having to make rushed or painful financial decisions at the worst possible time.

2. Your Exposure as a Pilot

Not all flying carries the same level of risk, and that matters when deciding how much accident insurance coverage you need.

A pilot who flies occasionally on clear days faces very different exposure than someone who flies frequently, operates at night, navigates mountain or backcountry terrain, or flies older or experimental aircraft. Acting as a pilot in command with passengers on board also increases responsibility and potential financial impact.

Simply put, the more often you fly and the more complex your flying environment is, the greater your exposure becomes. That’s why the best accident insurance coverage for private pilots isn’t one-size-fits-all; it’s tailored to how, when, and why you fly.

3. Passenger Responsibility (Even Non-Liability Risk)

Even though accident insurance is not the same as liability coverage, it becomes far more important (both emotionally and financially) when passengers are involved.

Many pilot-focused accident policies provide benefits not only for the pilot but also for passengers, often structured as coverage per seat or per person.

If you regularly fly with family members, friends, or business associates, this coverage deserves special attention. It is wise to match, or even exceed, the accident benefit you carry for yourself with the amount provided for your passengers. This ensures everyone on board is protected while reducing the financial strain on the people who matter most.

4. Income Protection and Career Risk

Aviation accidents don’t have to be fatal to create lasting financial damage. Injuries that affect vision, hand or arm function, or overall mobility can permanently disrupt your ability to work, even if you never plan to fly again. That’s why income protection is a critical part of accident insurance coverage.

Many policies include structured benefits for dismemberment, permanent total disability, or partial disability, providing financial support when your earning power is compromised. For high-income professionals and business owners, this type of protection can be just as important as a death benefit, because it helps preserve income and stability after a life-altering injury.

5. Cost vs. Coverage Reality

Here’s the part that surprises most pilots: accident insurance coverage is far more affordable than they expect.

In many cases, $250,000 of coverage costs under $150 per year. For higher limits, $500,000 often runs between $200 and $300 annually. Even a $1 million policy typically falls within the affordable range of $400 to $700.

A serious aviation accident can have a devastating financial impact. Aviation accident insurance provides a high-impact layer of protection for a remarkably low cost.

Personal Accident Insurance Coverage vs. Aviation-Specific Policies

It’s a common misconception that all accident policies are created equal. If you’re a pilot, the “fine print” in a standard policy can be the difference between being fully covered and having no coverage at all.

Standard Personal Accident Insurance

Think of this as your “everyday” insurance. It’s there to cover the risks most people face in daily life, like car accidents and slips and falls. However, the catch is that many of these policies specifically exclude “hazardous activities,” which often include private aviation. Even if they do cover it, the benefits are frequently limited.

Aviation-Specific Accident Insurance

Aviation-specific accident insurance is built specifically for the risks pilots and passengers face in private aircraft. These policies explicitly include private aviation, clearly define covered scenarios, and outline upfront benefit schedules for pilots and passengers.

Because they are tailored to how pilots actually fly, aviation-specific accident policies typically provide more reliable and predictable protection. For most private pilots, this type of coverage is almost always the better choice.

What Should You Look for in the Best Accident Insurance Coverage for Private Pilots?

When you’re digging into the fine print, don’t let the legal jargon distract you. A solid pilot-focused policy should be straightforward. Here is what you should actually be looking for:

- “Private Aviation” Named Outright: You shouldn’t have to guess if you’re covered. Look for language that explicitly includes general aviation or private piloting.

- Zero Gray Areas: If there are exclusions that feel “open to interpretation,” move on. You want a policy that is black-and-white about when it pays out.

- Simple Lump-Sum Payouts: In a crisis, you don’t want to be filing a thousand receipts. Look for policies that provide a single, one-time payment to help you or your family pivot quickly.

- Passenger Protection: Your friends and family are in your hands. Ensure the policy extends coverage to the people sitting in the seats next to you, not just the person at the controls.

- A Clear “Roadmap” for Disability: Check the benefit schedules for dismemberment or disability. It should clearly state exactly what is paid out for specific injuries so there are no surprises during recovery.

- A Solid Beneficiary Setup: It sounds simple, but ensure the process for naming and updating your beneficiaries is ironclad and easy to manage.

The Golden Rule: If the language feels intentionally confusing or “vague,” consider it a red flag. The best insurance for a pilot is the one that doesn’t require a law degree to understand.

Conclusion: Fly with Certainty

Accident insurance isn’t about expecting the worst; it’s about making sure that if the unexpected does happen, financial chaos isn’t part of the aftermath. The right coverage allows you to focus on the flight, knowing your family and your future are secure.

Don’t wait for a “red flag” moment to find out your policy has an aviation exclusion. Whether you need to review your current limits or build a new policy from the ground up, the experts at Abrams Insurance specialize in protecting pilots like you.

Before your next takeoff, make sure your accident insurance coverage is built for private aviation.